Article

The Future of MedTech: Insights from Industry Leaders

The people who manage trillions of dollars in stock and bonds are already telling their portfolio companies in every sector what they want to see them doing. For these investment managers, it’s not about playing games with financial instruments or raising earnings-per-share in Q2, Q3 or even Q4 of 2020. It’s about thriving in the emerging COVID-19 Economy.

What they are saying boils down to this:

Investment managers in MedTech appear to be in sync with this overall market perspective and have opinions about how this advice translates for their sector. MedTech investors are seeing an acceleration of many industry trends that were already underway. In addition, they believe that COVID-19 is reshuffling some of the priorities of the healthcare system. Finally, there is a strong consensus that digital, connected, data, and software are four words essential to future success.

It’s now clear that COVID-19 is more than a passing phase. Given the collective motivation, scientific knowledge, connectivity, industrial horsepower, and wealth of our country and world in 2020, we can and will defeat COVID-19. But there is no definite timeline for victory. And once we have declared victory, our world is not just going to pick up where we left off around Valentine’s Day of 2020. In addition to the damage and change that COVID-19 and the fight against it will leave behind, we can’t assume that this pandemic is a one-of-a-kind global crisis. Due to a confluence of global trends in travel, commerce, public health, and the environment, the Mean Time Between Global Pandemics (MTBGP) has been dramatically reduced and we need to be better prepared for “COVID-20” and “COVID-21” than we were for this time.

At the risk of making another obvious point, when this is over we should not expect that our economy, healthcare system, government, or society will simply snap back to how things were before. Some things may be worse off than before and others may be better. But even if not clearly better or worse, much will simply be different. For example, our global, just-in-time supply chain coupled with low on-site inventory is no longer an option for essential pandemic products like personal protective equipment, prescription drugs, and ventilators. And the next time the Cubs win a World Series, 5 million people may not feel safe meeting up in downtown Chicago to celebrate, once again breaking world records for the largest-ever gathering in the Americas and the 7th largest in human history.

Photo from Chicago Cubs’ Twitter feed.

In a massive economic slowdown, it can be difficult – if not impossible – just to keep the lights on.

However, long-term investors are very clear that for the companies they invest in, it can’t only be about staying in business. These investors understand that, for better and worse, pandemics, wars, and other upheavals ignite a process of creating new winners and losers in the market. In their minds, there is a relatively narrow window for firms to make strategic bets that can have enormous long-term upsides. However, those bets can carry large risks and opportunity costs, making it all the more important to place the right ones. Former Chicago Mayor Rahm Emmanuel revived the classic expression, “Never let a good crisis go to waste.”

It’s fair to note that investment managers are not the only influencers in the MedTech market. However, they are worth paying attention to both because they do have significant influence and much of that influence has been accrued through having insights into where things are headed.

Since the early weeks of this economic crisis, the consulting firm BCG has been conducting the COVID-19 Investor Pulse Check Series surveys. These quick-turnaround surveys tracking changing opinions among investment managers who collectively manage over $4 trillion in assets. The data collected between May 1-3 showed some very interesting and relevant trends:

A majority of survey respondents are (to greater and lesser extents) writing off 2020 as something of a lost year for the economy. They are not expecting strong returns for this year and appreciate that for some firms, it’s very hard to accurately forecast results for the next few quarters.

Having greatly downsized their expectations for 2020, these investment managers want to see companies do two things to ensure success in 2020 and beyond:

Investors want companies to get access to a lot of liquidity (i.e., raise cash for a big war chest) to be ready to play a long game. The companies can then lean on that cash to give them more degrees of freedom to make decisions during this downturn that are strategic and proactive. Beyond simply managing expenses, companies can raise money using financial instruments such as issuing new debt or offering new shares of stock.

Investors think that the most successful companies will use their war chests to make strategic moves that position them for long-term success. (As opposed to either hunkering down to just to stay in business or trying to preserve short-term profits at the expense of long-term goals.) As BCG puts it, “Investors want financially healthy companies to invest to create advantage.”

In other words, don’t get stuck on solutions that no longer solve your customers’ problems.

Interestingly, two questions in the survey illustrated some possible tension between a preference for keeping cash on hand for more and harder rains in the coming 12 months and using that cash to place big bets with long term results.

So business leaders in MedTech and other industry sectors need to be playing a very sophisticated and strategic game involving an unusually high number of unknown factors that impact decisions. In addition, key decisions will have to balance tradeoffs impacting the short-, medium- and long-terms.

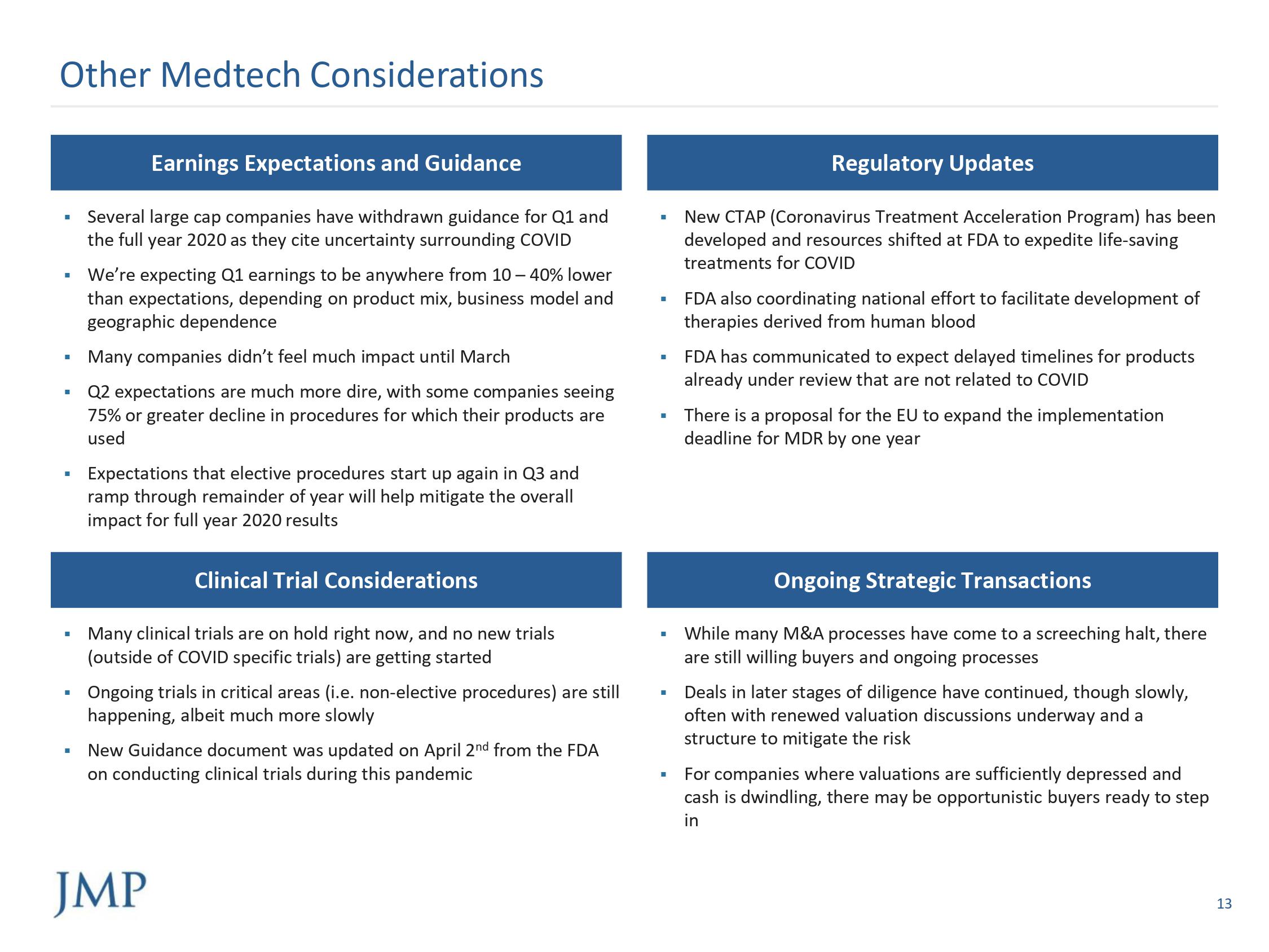

As we narrowed our focus from financial markets overall to the MedTech sector, the story we have found is fairly consistent. However, there are important nuances that reflect how different types of MedTech firms are being impacted by the downturn and how they should be positioned over the coming year and beyond. The most concise and timely analyses we have found about MedTech capital markets and deal flow come from the MedTech investment banking team at JMP Group, including Carin Fradin and Ken Klausman. Some of the key insights from JMP (and others) are fairly intuitive:

Our favorite inbound messages after a new post do not start with, “Great post. Keep up the good work.” Our favorites are the ones that start with, “I read your post and I disagree when you said x because you are not taking y and z into consideration.”

Our ideas are ultimately strengthened by open, candid conversations. We’d love to hear from you about this blog post and the ones in the pipeline. Do you agree with our take? Disagree? Have questions? Have you read an article that we should read? Feel free to reach out to our CEO, Bernhard Kappe or VP, Solutions & Partnerships, Randy Horton.

In return, we will look for ways to share more blogs, personalized insights, content, and introductions that are highly relevant to your work.

In future blogs, we plan to dive into the best of what we are reading and hearing about in the industry. Topics we plan to address include:

With a strong sense of urgency, Orthogonal is actively developing a point-of-view of what this pandemic and its aftershocks mean for medical device firms and their innovators creating Connected Mobile Medical Devices (CMMD) and Software as a Medical Device (SaMD).

Given the unsettling and largely-unexpected acceleration of change in 2020, we see an opportunity to add value to our industry by synthesizing and sharing the best of what we are learning on an ongoing basis. In the end, it’s important that we all succeed because every person in our lives is a customer of healthcare and life sciences.

Orthogonal is a software developer for Connected Mobile Medical Devices (CMMD) and Software as a Medical Device (SaMD). We work with change agents who are responsible for digital transformation at medical device and diagnostics manufacturers. These leaders and pioneers need to accelerate their pipeline of product innovation to modernize patient care and gain competitive advantage.

Orthogonal applies deep experience in CMMD/SaMD and the power of fast feedback loops to rapidly develop, successfully launch, and continuously improve connected, compliant products—and we collaborate with our clients to build their own rapid CMMD/SAMD development engines. Over the last 8 years, we’ve helped a wide variety of firms develop and bring their regulated/connected devices to market. If you need help building your next CMMD or SaMD, or to learn more, contact us or call us at (866) 882-7215.

**

Bernhard Kappe is Founder and CEO at Orthogonal. You can email him at [email protected]

Randy Horton is VP of Solutions and Partnerships at Orthogonal. You can email him at [email protected]

Related Posts

Article

The Future of MedTech: Insights from Industry Leaders

Article

Studying Compliance Burden to Improve SaMD Development

Article

Lifestyle Integration for Medical Devices

Article

CEOs and other Digital Health Experts on SaMD in 2020